A MODERN CASH HUB BUILT FOR THE WEALTH INDUSTRY

Our cash hub has been purpose-built as an IDPS-Like

Scheme, with Equity Trustees as Custodian, giving brokers,

advisers, licensees, and clients the confidence of a

regulated and robust structure. Unlike traditional

single-bank arrangements, our scheme has the ability to

hold multiple banks and multiple currencies, creating

flexibility and resilience in a fast-changing financial

environment. We proudly support National Australia Bank as

our initial banking partner.

Seamless Technology & Market Integration

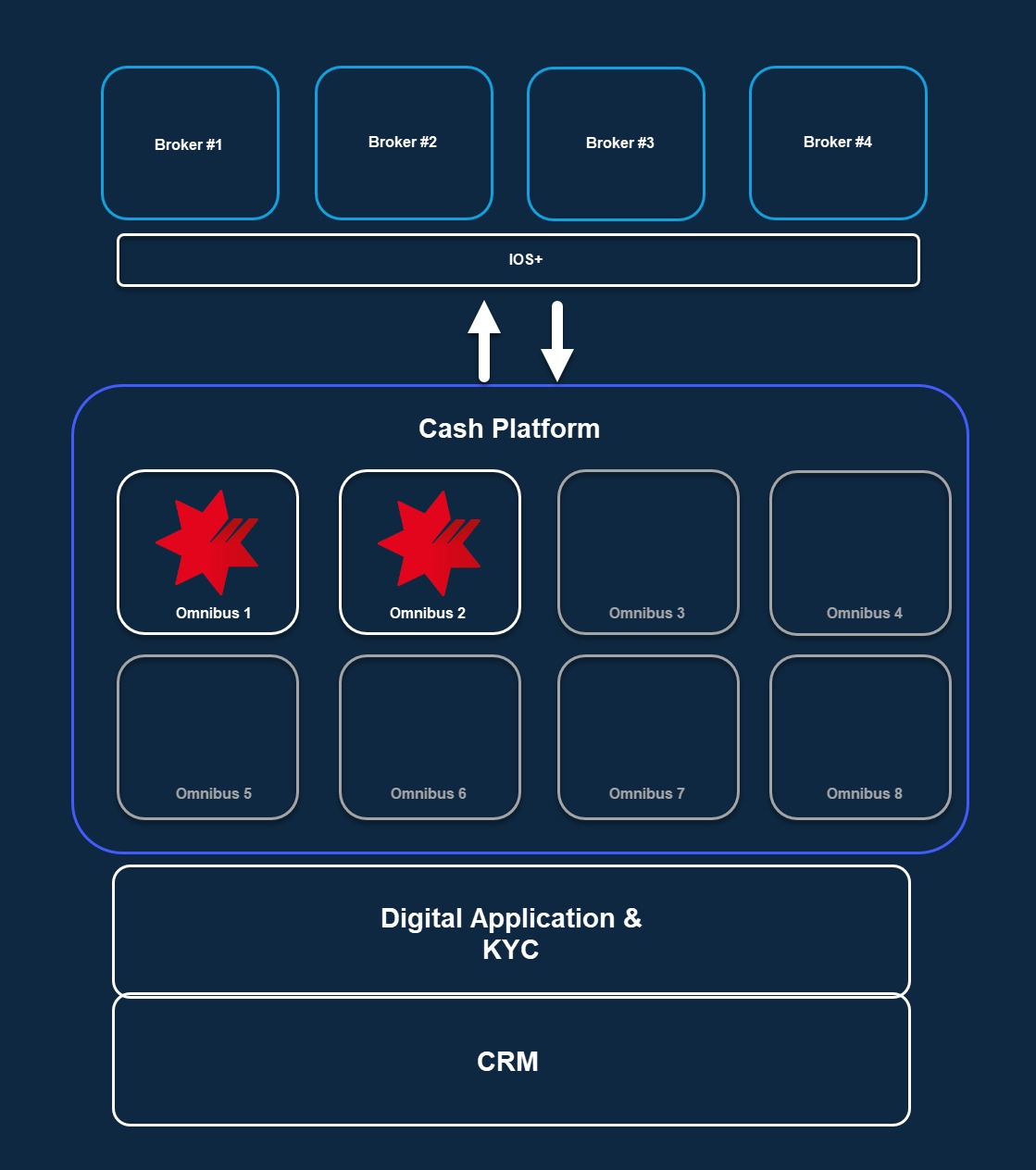

As the scheme’s Administrator, we have built the technology and KYC processes to allow smooth, efficient, and compliant account opening. Also, at the core of our solution is cutting-edge technology, fully integrated into major stockbrokers via IRESS IOS+. This allows trades and cash management instructions to flow in real time—directly from our platform to the market. Whether through desktop or our intuitive mobile app, stakeholders can view the entire wealth portfolio, place trades, or manage cash with speed and confidence.

Benefits for All Stakeholders

Next Generation Wealth Management

By bringing together custodial strength, multi-bank flexibility, compliant onboarding, and real-time technology, our solution transforms cash from a passive holding account into the backbone of modern wealth management.

Seamless Technology & Market Integration

As the scheme’s Administrator, we have built the technology and KYC processes to allow smooth, efficient, and compliant account opening. Also, at the core of our solution is cutting-edge technology, fully integrated into major stockbrokers via IRESS IOS+. This allows trades and cash management instructions to flow in real time—directly from our platform to the market. Whether through desktop or our intuitive mobile app, stakeholders can view the entire wealth portfolio, place trades, or manage cash with speed and confidence.

Benefits for All Stakeholders

- Brokers: reduced settlement risk through cash-funded trades and live integration.

- Advisers: innovative digital tools that simplify portfolio management, automate administration, and free time for client engagement.

- Licensees: greater oversight and stronger governance supported by trusted custodianship.

- Clients: real-time transparency, mobile access, and an enhanced wealth experience.

Next Generation Wealth Management

By bringing together custodial strength, multi-bank flexibility, compliant onboarding, and real-time technology, our solution transforms cash from a passive holding account into the backbone of modern wealth management.